In May 2024, the US freight industry experienced notable changes in van, reefer, and flatbed freight rates. Understanding the latest data is crucial for making informed decisions as businesses navigate these shifts. This article delves into the current statistics, regional variances, and load-to-truck ratios to provide a comprehensive overview of the freight landscape.

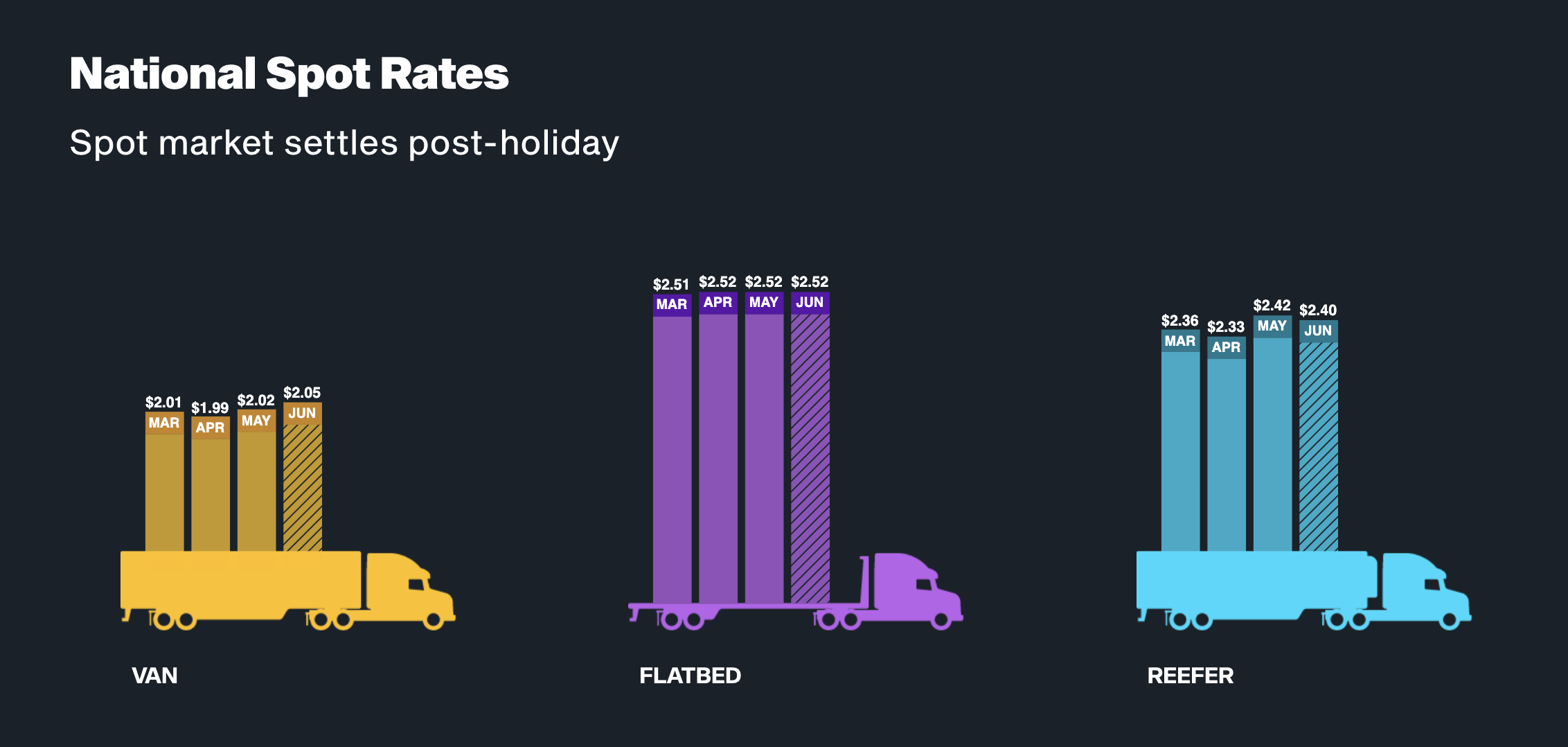

The DAT Trendlines Report from May 19th, 2024, highlights a slight increase in national van rate averages, now at $2.01 per mile, up by $0.02 from April. This increment, though modest, signals an ongoing adjustment in the freight market.

Regional Breakdown of Van Freight Rates

The national load-to-truck ratio has surged to 4.93, a significant jump from April’s 3.54. This ratio is a critical indicator of market balance, suggesting a heightened demand for van freight services relative to available trucks.

Reefer freight rates have seen a downturn, averaging $2.40 per mile in May 2024, down by $0.07 from April. This decline might reflect seasonal shifts or changes in supply chain dynamics.

Reefer capacity has increased significantly, with a national load-to-truck ratio of 7.91, compared to April’s 4.78. This rise suggests a considerable increase in reefer freight demand.

Flatbed freight rates have marginally increased to an average of $2.53 per mile in May, up by $0.01 from April. This stability indicates a balanced supply-demand dynamic in the flatbed segment.

Impact of Freight Rate Trends on the Industry

Understanding these freight rate trends is essential for stakeholders in the logistics and transportation sectors. The variations in rates and load-to-truck ratios across different regions indicate shifting demands and capacities that can influence pricing, service availability, and strategic planning.

Navigating the Current Freight Market

These statistics provide critical insights for optimizing logistics strategies for businesses relying on freight services. Adjusting to regional rate variances and understanding load-to-truck dynamics can lead to more efficient and cost-effective operations.